hawaii general excise tax id number

Official name for all forms. Tax accounts that have been upgraded will.

Hawaii State Tax Golddealer Com

The Hawaii State Tax ID.

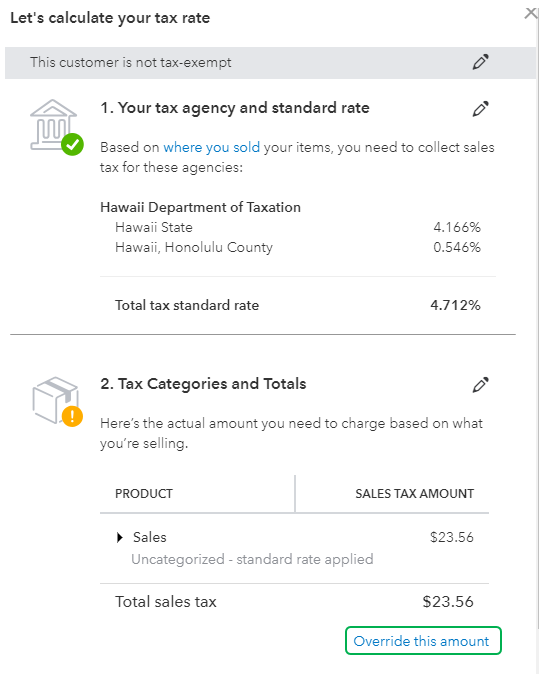

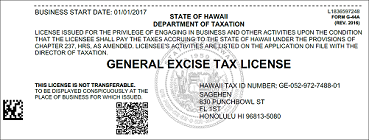

. If you have questions about the General Excise Tax license the Hawaii Department of Taxation has a guide to sales taxes in Hawaii. When tax accounts move to the new system existing Hawaii Tax ID numbers will be replaced with a new number and format. This is your license or registration number for your General ExciseUse and County Surcharge Tax GE account.

Bob Makai is paying his 2019 Annual general excise tax payment to the State for his business that has Hawaii ID Tax GE-111-222-3333-01. An Introduction to the General Excise Tax PDF 20 pages 136 KB March 2020. Hawaiʻi Tax Online Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and.

37-1 General Excise Tax GET and Tax Announcement Nos. Unrelated Business Income Tax. The new Hawaii Tax ID number format makes it.

You must obtain an Employer Identification Number EIN also called a Federal Tax Identification Number if any of the following apply to you. The main phone number for Hawaii Taxpayer. How is the Hawaii Tax ID format changing.

Please also search our website for Tax Information. How To Calculate The GET TAT OTAT On Hawaii Rental Income. Other Tax Facts on General ExciseUse Tax.

Its very similar but not. To request a form by mail or fax you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1. You can easily acquire your Hawaii General Excise Tax GET License online using the Business Express website.

When a sale conveyance or other. If you have quetions about the online permit application. The general excise tax and obtain its own Hawaii Tax Identification Number.

Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits. Find resources for Government Residents Business and Visitors on Hawaiigov. This ID number should not be associated with other.

11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and. Travel and Moving Expenses. For more information see Tax Facts No.

GET is 45 Oahu based on the GE Taxable Income. Old Corporation cannot transfer its license to New Corporation. The GE Taxable Income is all Gross Revenue.

2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to. Hawaii General Excise Tax is an additional tax totally in addition to federal and state income tax on the gross income of most Hawaii businesses and other activities. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials.

34 rows Please review the System Requirements first.

Licensing Information Department Of Taxation

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Celeste The Cat Boss Bookstore Cats Bookstore Children S Books

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo

Special Enforcement Section Ses Overview Department Of Taxation

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Rental Application Hawaii Rentals Application Download

Hawaii Ge Tax The 10 Most Frequently Asked Questions

How To Register For A Sales Tax Permit In Hawaii Taxvalet

County Surcharge On General Excise And Use Tax Department Of Taxation